Roll-to-Roll Flexible Electronics Manufacturing in 2025: Unleashing Rapid Innovation and Market Expansion. Explore How Advanced Processes Are Shaping the Future of Electronics Production.

- Executive Summary: 2025 Market Highlights and Key Trends

- Roll-to-Roll Technology Overview: Principles and Process Innovations

- Current Market Size and 2025–2030 Growth Forecasts (CAGR: ~17%)

- Major Players and Industry Ecosystem (e.g., panasonic.com, samsung.com, flexenable.com)

- Emerging Applications: Wearables, IoT, Automotive, and Healthcare

- Materials and Substrate Advancements: Polymers, Metals, and Hybrid Films

- Production Challenges: Yield, Scalability, and Quality Control

- Sustainability and Environmental Impact Initiatives

- Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World

- Future Outlook: Disruptive Opportunities and Strategic Recommendations

- Sources & References

Executive Summary: 2025 Market Highlights and Key Trends

Roll-to-roll (R2R) flexible electronics manufacturing is poised for significant growth and transformation in 2025, driven by surging demand for lightweight, flexible, and cost-effective electronic components across diverse industries. The R2R process, which enables continuous fabrication of electronic devices on flexible substrates, is increasingly being adopted for applications such as flexible displays, wearable sensors, smart packaging, and photovoltaic cells.

In 2025, the market is witnessing robust activity from established electronics manufacturers and material suppliers. Samsung Electronics continues to advance its R2R capabilities, particularly in the production of flexible OLED displays for smartphones and emerging foldable devices. LG Display is similarly expanding its R2R-based manufacturing lines, focusing on large-area flexible displays and signage. These companies are leveraging R2R to achieve higher throughput and lower production costs compared to traditional batch processing.

Material innovation remains a key trend, with companies like DuPont and Kuraray supplying advanced conductive inks, barrier films, and flexible substrates tailored for R2R processing. DuPont has introduced new generations of silver nanowire and carbon-based inks, enabling finer patterning and improved device performance. Meanwhile, Kuraray is expanding its portfolio of high-performance polymer films, which are critical for the durability and flexibility of end products.

The energy sector is also a major driver, with First Solar and Heliatek scaling up R2R production of flexible photovoltaic modules. These companies are targeting building-integrated photovoltaics (BIPV) and portable solar solutions, capitalizing on the lightweight and conformable nature of R2R-fabricated solar films.

Looking ahead, the outlook for R2R flexible electronics manufacturing in 2025 and beyond is characterized by continued investment in automation, process integration, and quality control. Equipment suppliers such as Meyer Burger Technology are introducing next-generation R2R coating and printing systems, designed to support higher speeds and tighter tolerances. Industry collaborations and standardization efforts are expected to accelerate commercialization, particularly in automotive interiors, medical devices, and IoT-enabled smart labels.

Overall, 2025 marks a pivotal year for R2R flexible electronics, with the convergence of material science, process engineering, and end-market demand setting the stage for rapid adoption and new product innovations.

Roll-to-Roll Technology Overview: Principles and Process Innovations

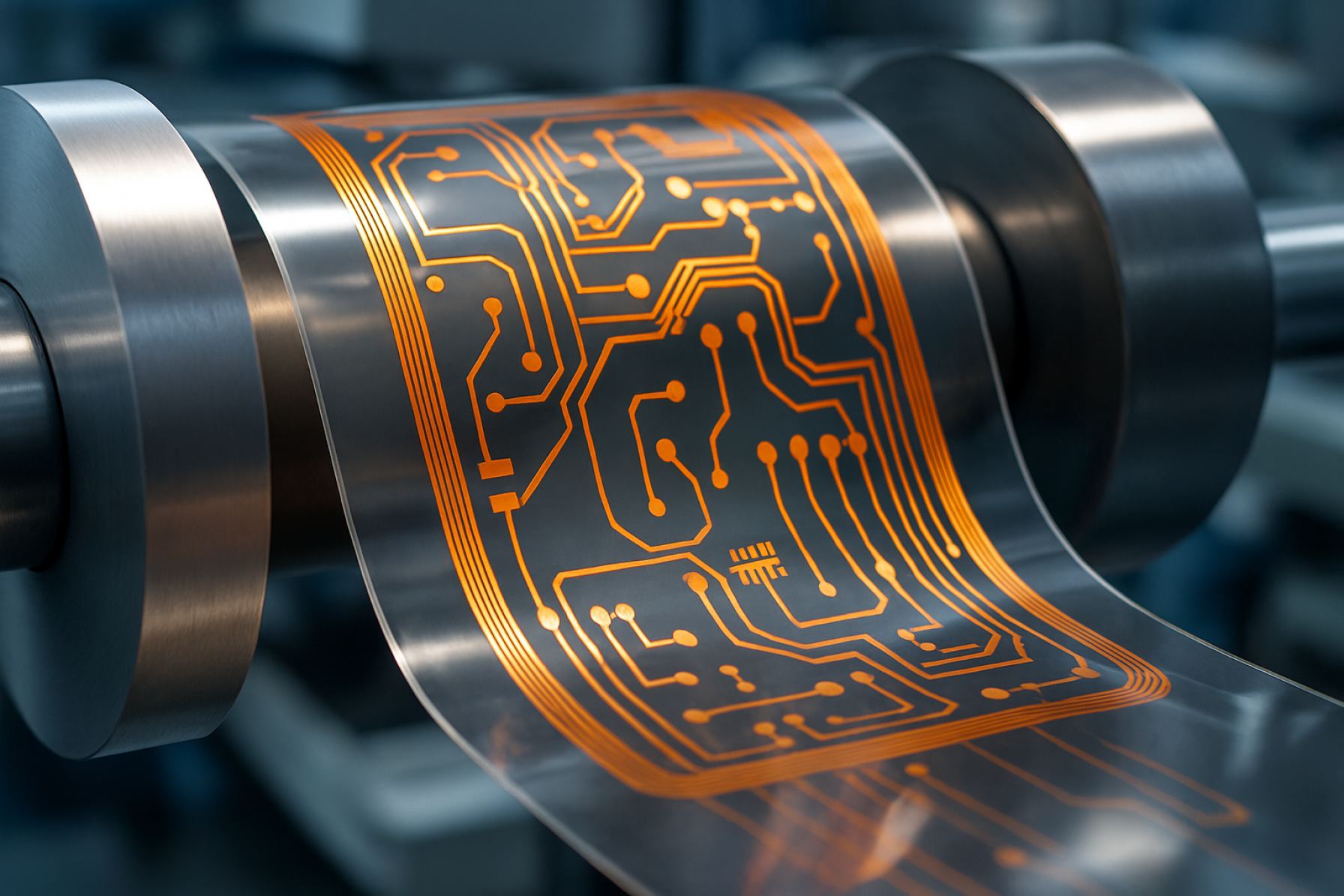

Roll-to-roll (R2R) technology is a cornerstone of modern flexible electronics manufacturing, enabling the continuous production of electronic devices on flexible substrates such as plastic films or metal foils. The fundamental principle involves unwinding a substrate from a feed roll, processing it through various functional layers—such as printing, coating, or patterning—and rewinding the finished product onto a take-up roll. This approach offers significant advantages in scalability, throughput, and cost-effectiveness compared to traditional batch processing.

In 2025, R2R manufacturing is witnessing rapid advancements in both process integration and material compatibility. Key process innovations include the adoption of high-resolution gravure, inkjet, and screen printing techniques for depositing conductive, semiconductive, and dielectric materials. These methods are being refined to achieve sub-10-micron feature sizes, essential for next-generation flexible displays, sensors, and photovoltaic devices. Companies such as Konica Minolta and Japan Pulp & Paper Company are actively developing R2R printing systems tailored for electronics, focusing on precision registration and multilayer alignment.

Another significant trend is the integration of in-line inspection and metrology tools within R2R lines. Real-time monitoring of layer thickness, electrical performance, and defect detection is becoming standard, driven by the need for higher yields and reliability in mass production. Meyer Burger Technology AG, a leader in photovoltaic manufacturing equipment, has introduced R2R systems with advanced optical and electrical inspection modules, supporting the production of flexible solar cells and modules.

Material innovation is also central to R2R progress. The development of new printable inks—such as silver nanowire, carbon nanotube, and organic semiconductors—enables the fabrication of flexible circuits with improved conductivity and mechanical durability. DuPont Electronics & Industrial is expanding its portfolio of conductive inks and barrier films specifically engineered for R2R processing, targeting applications in wearable electronics and smart packaging.

Looking ahead, the outlook for R2R flexible electronics manufacturing is robust. The convergence of process automation, advanced materials, and digital printing is expected to further reduce production costs and expand the range of applications. Industry collaborations, such as those led by FlexEnable in organic LCD and sensor technologies, are accelerating the commercialization of flexible displays and medical diagnostics. As R2R platforms become more versatile and reliable, they are poised to play a pivotal role in the mass adoption of flexible, lightweight, and low-cost electronic devices over the next several years.

Current Market Size and 2025–2030 Growth Forecasts (CAGR: ~17%)

The roll-to-roll (R2R) flexible electronics manufacturing sector is experiencing robust growth, driven by increasing demand for lightweight, flexible, and cost-effective electronic components across industries such as consumer electronics, automotive, healthcare, and energy. As of 2025, the global market size for R2R flexible electronics manufacturing is estimated to be in the range of several billion USD, with leading industry participants reporting significant capacity expansions and new product launches. The sector is projected to achieve a compound annual growth rate (CAGR) of approximately 17% from 2025 through 2030, reflecting both technological advancements and expanding end-use applications.

Key players in the R2R flexible electronics ecosystem include major materials suppliers, equipment manufacturers, and device integrators. Konica Minolta has been at the forefront of R2R printed electronics, leveraging its expertise in functional films and precision coating to supply materials for flexible displays and sensors. Samsung Electronics continues to invest in flexible OLED and sensor technologies, utilizing R2R processes for next-generation displays and wearable devices. LG Electronics and Sony Corporation are also active in the development and commercialization of flexible displays and printed sensors, with ongoing investments in R2R pilot lines and production facilities.

On the materials and equipment side, DuPont supplies conductive inks and flexible substrates tailored for R2R processing, while Meyer Burger Technology AG and Roland DG Corporation provide advanced R2R printing and coating equipment. These companies are scaling up their offerings to meet the growing demand for high-throughput, high-precision manufacturing solutions.

The growth outlook for 2025–2030 is underpinned by several factors. The proliferation of flexible and wearable devices, the integration of flexible sensors in automotive and healthcare applications, and the adoption of R2R-processed photovoltaic and energy storage devices are all expected to drive market expansion. Industry initiatives to improve yield, reduce costs, and enable mass customization are further accelerating adoption. For example, Konica Minolta and Samsung Electronics have both announced plans to expand their R2R manufacturing capabilities to support new product lines and address emerging market needs.

Overall, the R2R flexible electronics manufacturing market is poised for sustained double-digit growth through 2030, with ongoing investments from established electronics giants and specialized suppliers ensuring continued innovation and capacity expansion.

Major Players and Industry Ecosystem (e.g., panasonic.com, samsung.com, flexenable.com)

The roll-to-roll (R2R) flexible electronics manufacturing sector in 2025 is characterized by a dynamic ecosystem of established electronics giants, specialized technology developers, materials suppliers, and equipment manufacturers. This collaborative landscape is driving rapid innovation and commercialization of flexible displays, sensors, photovoltaics, and smart packaging.

Among the most prominent players, Panasonic Corporation continues to leverage its expertise in materials science and electronics integration. The company has invested in R2R processes for flexible printed circuit boards and organic light-emitting diode (OLED) displays, targeting applications in automotive interiors and next-generation consumer devices. Similarly, Samsung Electronics remains a global leader, with its R2R manufacturing lines supporting the mass production of flexible OLED panels for smartphones, wearables, and foldable devices. Samsung’s ongoing advancements in thin-film encapsulation and barrier technologies are critical for improving device durability and performance.

In Europe, FlexEnable stands out as a pioneer in organic electronics and flexible display technology. The company’s R2R manufacturing platform enables the production of ultra-thin, lightweight displays and sensors on plastic substrates, with commercial deployments in automotive curved displays and biometric sensors. FlexEnable’s partnerships with display manufacturers and automotive suppliers are accelerating the adoption of flexible electronics in mainstream markets.

Materials innovation is another cornerstone of the ecosystem. DuPont supplies advanced conductive inks, flexible substrates, and encapsulation materials tailored for R2R processing. These materials are essential for achieving high throughput and reliability in flexible electronic devices. Kuraray and Toray Industries are also key suppliers, providing specialty films and resins that enable mechanical flexibility and chemical resistance.

On the equipment side, Meyer Burger Technology and Manz AG offer R2R production systems for printed electronics, photovoltaics, and battery components. Their modular platforms support high-speed, large-area processing, which is vital for scaling up production and reducing costs.

The industry ecosystem is further strengthened by collaborative initiatives involving research institutes, such as the Holst Centre in the Netherlands, which partners with industrial players to advance R2R process integration and reliability. As the market for flexible electronics expands—driven by demand in consumer electronics, automotive, healthcare, and energy—these major players are expected to deepen their investments in R2R technology, with a focus on higher yields, improved device lifetimes, and new form factors through 2025 and beyond.

Emerging Applications: Wearables, IoT, Automotive, and Healthcare

Roll-to-roll (R2R) flexible electronics manufacturing is rapidly advancing as a foundational technology for next-generation applications in wearables, IoT, automotive, and healthcare. As of 2025, the sector is witnessing significant momentum, driven by the demand for lightweight, conformable, and cost-effective electronic devices. R2R processes enable continuous fabrication of electronic circuits on flexible substrates, such as plastic films or metal foils, at high throughput and lower costs compared to traditional batch processing.

In the wearables sector, R2R manufacturing is enabling the mass production of flexible sensors, displays, and energy storage devices that can be seamlessly integrated into clothing, accessories, and skin patches. Companies like Polar Electro and LG Electronics are leveraging flexible electronics for advanced fitness trackers and smartwatches, incorporating stretchable circuits and flexible OLED displays. The ability to print conductive inks and functional layers on flexible substrates is also facilitating the development of electronic skin patches for continuous health monitoring, a field where Nitto Denko Corporation is actively involved.

For IoT applications, R2R technology is crucial in producing low-cost, flexible RFID tags, sensors, and antennas that can be embedded in packaging, logistics, and smart infrastructure. Smartrac Technology, a key player in RFID and IoT solutions, utilizes R2R processes to manufacture millions of flexible RFID inlays annually, supporting the scalability required for ubiquitous IoT deployment. The integration of printed batteries and energy harvesting components, as pursued by Enfucell, further enhances the autonomy and versatility of IoT devices.

In the automotive industry, R2R flexible electronics are being adopted for interior and exterior applications, including flexible lighting, touch sensors, and in-mold electronics. Continental AG is exploring R2R-printed flexible circuits for smart surfaces and human-machine interfaces, aiming to reduce weight and improve design flexibility in vehicle cabins. Flexible printed heaters and sensors are also being integrated into seats, steering wheels, and windshields, enhancing comfort and safety.

Healthcare is another sector experiencing transformative impact from R2R manufacturing. Flexible biosensors, diagnostic strips, and smart bandages produced via R2R processes are enabling real-time, non-invasive health monitoring and point-of-care diagnostics. Johnson & Johnson and 3M are among the companies developing flexible medical devices and wearables, leveraging R2R for scalable production and rapid innovation cycles.

Looking ahead, the outlook for R2R flexible electronics manufacturing remains robust. Ongoing advancements in materials, printing techniques, and integration methods are expected to further expand the range of applications and drive down costs. As industry standards mature and ecosystem partnerships strengthen, R2R is poised to become the backbone of flexible, connected devices across multiple sectors in the coming years.

Materials and Substrate Advancements: Polymers, Metals, and Hybrid Films

The evolution of materials and substrates is central to the progress of roll-to-roll (R2R) flexible electronics manufacturing, with 2025 marking a period of rapid innovation and commercialization. The industry is witnessing a shift from traditional rigid substrates to advanced polymers, metals, and hybrid films, each offering unique advantages for large-area, high-throughput production.

Polymeric substrates remain the backbone of R2R flexible electronics due to their lightweight, flexibility, and cost-effectiveness. Polyethylene terephthalate (PET) and polyethylene naphthalate (PEN) are widely used, with ongoing improvements in thermal stability and barrier properties. Companies such as DuPont and Kuraray are actively developing new grades of high-performance films tailored for electronics, focusing on enhanced dimensional stability and reduced water vapor transmission rates. In 2025, the introduction of ultra-thin, optically clear polyimide films is enabling new applications in foldable displays and wearable sensors, with Kolon Industries and Sumitomo Chemical leading in commercial-scale production.

Metal foils, particularly ultra-thin stainless steel and copper, are gaining traction for applications requiring superior electrical conductivity and mechanical robustness. Rolled Alloys and Nippon Steel are supplying precision-rolled foils compatible with R2R processing, supporting the growth of flexible batteries, antennas, and power electronics. The challenge of surface smoothness and oxide layer control is being addressed through advanced surface treatments and lamination techniques, which are expected to mature further by 2026.

Hybrid films, combining polymers with inorganic layers or nanomaterials, are a focal point for next-generation flexible electronics. Atomic layer deposition (ALD) and solution-based coating methods are being scaled up to deposit ultra-thin barrier layers on flexible substrates, significantly improving device lifetimes. 3M and Toray Industries are at the forefront, offering multilayer barrier films that balance flexibility, transparency, and environmental resistance. These hybrid materials are crucial for organic light-emitting diode (OLED) displays, flexible photovoltaics, and medical sensors.

Looking ahead, the convergence of material science and R2R process engineering is expected to yield substrates with tailored functionalities—such as stretchability, self-healing, and integrated sensing—by 2027. The ongoing collaboration between material suppliers, equipment manufacturers, and device integrators is accelerating the commercialization of flexible electronics across consumer, automotive, and healthcare sectors.

Production Challenges: Yield, Scalability, and Quality Control

Roll-to-roll (R2R) manufacturing is a cornerstone technology for the scalable production of flexible electronics, enabling continuous processing of flexible substrates such as plastic films or metal foils. However, as the industry moves into 2025, several production challenges persist, particularly in the areas of yield, scalability, and quality control.

Yield remains a critical concern. The R2R process involves multiple sequential steps—coating, printing, drying, and patterning—each of which can introduce defects. Even minor misalignments or particulate contamination can result in significant yield losses, especially for high-density circuits or large-area devices. Leading manufacturers such as Kateeva and Jenoptik have invested in advanced in-line inspection systems and defect mapping to address these issues, but the complexity of multilayer structures and the sensitivity of organic materials continue to pose challenges.

Scalability is another major hurdle. While R2R is inherently designed for high-throughput production, scaling up from laboratory or pilot lines to full commercial manufacturing often reveals unforeseen bottlenecks. For example, uniform coating and registration over wide web widths (often exceeding one meter) require precise tension control and environmental stability. Companies like Meyer Burger Technology AG and Roland DG Corporation have developed specialized R2R equipment to address these needs, but the integration of new materials—such as perovskite inks for solar cells or novel conductive polymers—demands ongoing process optimization.

Quality control is increasingly reliant on real-time, in-line monitoring technologies. Traditional batch sampling is insufficient for the continuous, high-speed nature of R2R lines. As a result, manufacturers are deploying optical coherence tomography, machine vision, and spectroscopic sensors to detect defects and monitor layer thickness in real time. Jenoptik and Kateeva are among the companies advancing these solutions, aiming to reduce scrap rates and improve process yields.

Looking ahead to the next few years, the outlook for R2R flexible electronics manufacturing is cautiously optimistic. Industry players are investing in automation, artificial intelligence-driven process control, and new materials to overcome current limitations. However, the path to consistently high yields and robust scalability will require continued collaboration between equipment suppliers, material developers, and device manufacturers. As these challenges are addressed, R2R is expected to play a pivotal role in the mass production of flexible displays, sensors, and photovoltaic devices.

Sustainability and Environmental Impact Initiatives

Roll-to-roll (R2R) flexible electronics manufacturing is increasingly recognized for its potential to advance sustainability in the electronics sector. As of 2025, the industry is actively pursuing initiatives to reduce environmental impact across the entire value chain, from material selection to end-of-life management. R2R processes inherently offer advantages over traditional batch manufacturing, including lower energy consumption, reduced material waste, and the ability to use lightweight substrates such as PET, PEN, and biodegradable polymers.

Major industry players are investing in greener materials and closed-loop production systems. For example, Konica Minolta has developed R2R processes for organic light-emitting diode (OLED) lighting that utilize solvent-free inks and recyclable substrates, aiming to minimize hazardous waste and facilitate recycling. Similarly, Johnson Matthey is working on sustainable conductive inks and pastes, focusing on reducing the use of rare or toxic metals in printed electronics.

Efforts to improve energy efficiency are also evident. Meyer Burger, a leader in photovoltaic manufacturing equipment, has optimized its R2R systems for thin-film solar cell production to operate at lower temperatures and with less energy input, directly reducing the carbon footprint of solar module fabrication. Additionally, NovaCentrix is advancing photonic curing technologies that enable rapid, low-energy sintering of printed electronic circuits, further decreasing energy requirements compared to conventional thermal processes.

Waste reduction and recycling are central to current sustainability strategies. Companies such as FlexEnable are developing R2R-compatible processes that allow for the recovery and reuse of substrate materials and electronic inks. This approach not only diverts waste from landfills but also reduces the demand for virgin raw materials. Furthermore, industry consortia and standards bodies are collaborating to establish guidelines for eco-design and recyclability of flexible electronic products, with the goal of supporting a circular economy.

Looking ahead, the outlook for sustainability in R2R flexible electronics manufacturing is positive. Ongoing research into bio-based and compostable substrates, as well as the integration of life cycle assessment (LCA) tools into process development, is expected to further reduce environmental impacts. As regulatory pressures and consumer demand for greener electronics intensify, the sector is poised to accelerate the adoption of sustainable practices, making R2R manufacturing a key enabler of environmentally responsible electronics production in the coming years.

Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World

The global landscape for roll-to-roll (R2R) flexible electronics manufacturing is marked by distinct regional strengths and evolving investment patterns as of 2025. North America, Europe, and Asia-Pacific remain the primary hubs, each leveraging unique capabilities and market drivers, while the Rest of World (RoW) region is gradually increasing its participation through targeted initiatives and partnerships.

North America continues to be a leader in R2R innovation, driven by robust R&D ecosystems and a strong presence of technology companies. The United States, in particular, benefits from collaborations between major electronics manufacturers and research institutions. Companies such as 3M and DuPont are actively advancing flexible substrate materials and printable electronics, supporting applications in wearables, medical devices, and automotive sectors. The region is also witnessing increased investment in pilot production lines and scale-up facilities, with a focus on high-value, low-volume products that require rapid prototyping and customization.

Europe is characterized by a strong emphasis on sustainability and advanced materials. Germany, the Netherlands, and the United Kingdom are at the forefront, with companies like Holst Centre (a collaboration between TNO and imec) and NovaCentrix (with European operations) pushing the boundaries of printed and flexible electronics. The European Union’s funding programs, such as Horizon Europe, are fostering cross-border projects aimed at developing recyclable and energy-efficient R2R processes. Automotive and smart packaging are key application areas, with several pilot lines transitioning to commercial-scale production in 2025.

Asia-Pacific dominates in terms of manufacturing scale and cost efficiency. Countries like China, South Korea, and Japan are home to leading display and electronics manufacturers, including Samsung Electronics, LG Electronics, and Toppan. These companies are investing heavily in R2R lines for flexible OLED displays, sensors, and photovoltaic devices. The region benefits from integrated supply chains and government incentives, enabling rapid commercialization and export of R2R-based products. In 2025, Asia-Pacific is expected to account for the largest share of global R2R flexible electronics output, with ongoing expansion into emerging applications such as flexible batteries and electronic skin.

Rest of World (RoW) regions, including Latin America and the Middle East, are gradually entering the R2R flexible electronics space. While still nascent, these markets are attracting attention through government-backed innovation hubs and partnerships with established players from other regions. The focus is primarily on adapting R2R technologies for local needs, such as low-cost medical diagnostics and smart agriculture solutions.

Looking ahead, regional collaboration and technology transfer are expected to intensify, with North America and Europe focusing on high-value, sustainable solutions, and Asia-Pacific driving mass production and cost leadership. The RoW is poised for incremental growth as infrastructure and expertise develop, contributing to a more globally distributed R2R flexible electronics ecosystem by the late 2020s.

Future Outlook: Disruptive Opportunities and Strategic Recommendations

The future outlook for roll-to-roll (R2R) flexible electronics manufacturing in 2025 and the following years is marked by accelerating innovation, expanding market applications, and strategic shifts among industry leaders. R2R processes, which enable high-throughput, continuous fabrication of electronic devices on flexible substrates, are poised to disrupt traditional electronics manufacturing by reducing costs, increasing scalability, and enabling novel form factors.

Key industry players are intensifying investments in R2R capabilities. Samsung Electronics continues to advance flexible display and sensor technologies, leveraging R2R for next-generation foldable devices and wearable electronics. LG Electronics is similarly expanding its R2R-based OLED production, targeting both consumer electronics and automotive displays. Konica Minolta and Fujifilm are scaling up R2R manufacturing for flexible printed sensors and organic photovoltaics, with a focus on energy harvesting and smart packaging.

In 2025, the sector is expected to see significant growth in applications such as flexible displays, wearable health monitors, smart labels, and lightweight solar panels. Jabil, a global manufacturing solutions provider, is expanding its R2R production lines to meet demand for flexible hybrid electronics in medical and industrial IoT devices. Nitto Denko Corporation is advancing R2R processes for flexible printed circuits and pressure-sensitive sensors, targeting automotive and healthcare markets.

Strategically, companies are focusing on material innovation and process integration. The development of advanced conductive inks, barrier films, and stretchable substrates is critical for improving device performance and reliability. DuPont is investing in new generations of conductive pastes and dielectric materials tailored for R2R printing, while 3M is developing flexible adhesives and encapsulants to enhance device durability.

Looking ahead, disruptive opportunities are expected in the integration of R2R electronics with emerging technologies such as printed batteries, flexible antennas for 5G/6G, and large-area sensor networks. Strategic recommendations for stakeholders include fostering partnerships across the value chain, investing in pilot-scale R2R lines to accelerate commercialization, and prioritizing sustainability through recyclable materials and energy-efficient processes. As R2R manufacturing matures, it is set to redefine the economics and possibilities of electronics production, opening new markets and enabling ubiquitous, unobtrusive electronic integration in everyday life.